Totum Finance is a UK-based Independent Specialist Consultancy that provides business support to small and medium-sized enterprises. This FCA-authorised company acts as a credit broker that matches a crediting establishment with the most suitable borrower based on a specific set of features, characteristics, needs, and requirements. In this way, Totum Finance grants win-win solutions both for lenders by offering them perfectly matching clients and for lendees by providing them with the appropriate credit provider.

One of the urgent priorities in our client’s strategy for the next few years was the automatization of the internal data collection and analysis processes. The major issue to be addressed was ineffective time usage for data collection and processing. Since, back then, the company utilized a fully manual effort-consuming process for data harvesting from lenders and lendees, no less important was an optimization of human resource consumption in these processes.

- Business analytics research

- UI/UX design

- Web development

- Database creation

Solution & numeric data

Within one year our team developed a fully customized functional solution for data collection and analysis, as well as a results filter featuring data export in Excel document and PDF files for reporting. For company employees’ convenience, we linked some functions with CMS WordPress to ensure user-friendly moderation and management of the web application’s specific part. This project solution is being constantly improved, upgraded, and supplemented with new functions to optimize system performance.

experience

installs

played by us

coffee drinked

How it works

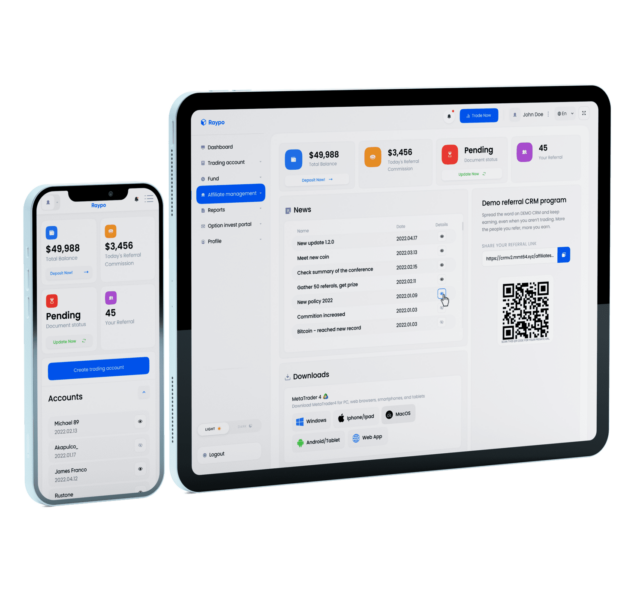

The system collects data based on borrowers’ and lenders’ needs and further compares it with the existing database to identify the best proposals to meet specific lender’s needs. As a result, the application generates the list of clients for credit organizations that match their current proposals, so lenders get the best proposals to meet their individual requirements with the best conditions at the market.

Complex analysis feature

The system also includes the features for complex and comprehensive analysis according to specific individual parameters and groups of parameters for reporting. It enables market tendency identification, analysis for indicated periods, and data export to Excel tables, PDF documents for reporting, reviewing, presenting, etc.

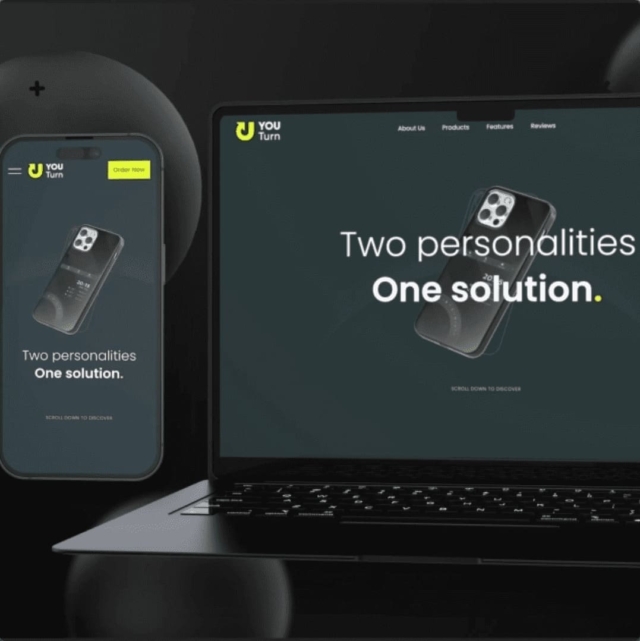

Clear and engaging web app

We created an easy-to-grasp and engaging web application in tight collaboration with marketing, financial teams, and the leadership of the company. Our top priority was to create a simple and smooth user experience for complex and overloaded bureaucracy procedures. Our developers succeeded in building an attractive and understandable interface design enabling to streamline the workflow.

Fully responsive and mobile-friendly

Convenience was crucial for Totum Finance, the managers required a user-friendly interface for highly complex functions that could be accessed at any device – laptop, phone, or tablet. After detailed discussions with the company’s leaders, in-depth target user audit, and research, we elaborated a fully responsive, mobile-friendly solution to make the complicated procedure easy and anytime available withing a few clicks even on a smartphone.

we have the specialized infrastructure to solve it.